Zulutrade is an automated forex system which allows users to open an account and automatically copy successful traders for free. It sounds too good to be true right? Well it is and it isn’t. Zulutrade has the potential to make very good returns if the right traders (signal providers) are selected to copy, but it isn’t as easy as it sounds. Just blindly selecting profitable signal providers to copy will lead to trouble without first analyzing the risk and setting stop losses manually to limit the losses that can be incurred by the signal providers. This article outlines how to go about doing this by using excel to analyze the trade history of zulutrade signal providers.

The signal provider information on Zulutrade is good but it only tells half the story. One of the good and bad aspects of Zulutrade is that anybody can become a signal provider. There are numerous instances of signal providers which show an impressive upward trending profit line and on first glance appear very attractive systems to follow. However it is not until you get into the detail that it becomes clear that these systems are workable only with unlimited capital demo accounts where large open losses can be rode out and sustained. In reality the systems would blow up very quickly as open losses and positions lead to a margin call.

If Zulutrade is going to work over the medium to long term it is imperative to use stop losses and calculate the optimum stop loss for each provider. This will vary depending upon each individuals risk appetite. For myself I do not want to be using signal providers who are not profitable with stops at 100 pips or less. The maximum stop loss I will set is 200 pips, ideally stops should be set under 100 pips. This is my preference only, some people will be comfortable and potentially far more profitable using much higher stops. So with these basic principles in mind I have developed an excel spreadsheet to calculate profit for signal providers using stops from 10 pips to 200 pips.

The first step is go to click on the performance tab in Zulutrade and select the signal provider who we will analyze in excel. Lets take the signal provider Forex Cruise Control. There are several good points that immediately stand out for Forex Cruise Control:

- An even 35 degree upward profitability curve with no major spikes down or upward, this indicates that the signal provider has a consistent trading strategy and probably operates with their own stop losses in place.

- Win % is 74% which is a good number. Beware of signal providers that show winning a % of 90-100%, if a signal provider has a 100% win percentage it is clear that they aren't using stops and will let losses ride until their losing positions turn around. These signal providers are unsustainable and while the results to date might appear very impressive it is inevitable that at some point the accounts will blow up as losses on open positions cause a margin call. On a demo account with near unlimited funds it is possible to maintain a 100% win ratio over a period of time, on a live account with limited funds it is not possible.

- Maximum drawdown 21% is a little on the high side but acceptable.

- Maximum open trades 7. This is good it shows the provider is not recklessly opening positions in order to gain commission. Beware of signal providers with max open trades of 20+, the more open positions at one time the higher the chance of a margin call if the trades turn against the provider.

- Other important considerations are the length of time the signal provider has been trading (in weeks) an

Okay so now that we have identified Forex Cruise Control as a prospective signal provider to follow we want to dig a little further and test how the profits are affected by applying a stop loss, we also want to know what the optimum stop loss we should use for this provider. To start looking at this information we click on the signal provider and scroll down to the trading history detail.

Then click on the export to excel link and export the file as a comma-separated values file (CSV File), this file contains all of the trading history for the signal provider to date.

Once the file has been saved open it up in excel and click on the data menu, import data from text file

Then click on the Forex Cruise Control csv file and import as a delimited file, click next.

We then want to click on the comma delimiter checkbox and click next.

Click through the next screen and click finish.

We then have an excel worksheet with the trade history data for Forex Cruise Control

What we now want to do is to create an 'if function' to factor in the use of stop losses to this raw trading data. There are many ways of doing this, I find the following way the easiest.

Create additional columns to the right of the trade data for the stop loss limits. I have used a range from 10 pips to 200 pips but you can make this whatever you like.

We then want to use an if function to calculate what the profit (in pips) would be if the signal provider used a stop loss. Cell N2 shows the function I have used, essentially it states if (worst drawdown column J) is less than the stop loss limit (cell N1 10 pips) then cell = worst drawdown. If the reverse is true and worse drawdown is greater than the stop loss then formula = profit (pips) column L.

Once you have successfully applied that formula copy the formula across all of the columns and down the rows for all of the trade data. When we have done that sum all of the columns which will then show the profit for each of the respective stops between 10 and 200 pips.

In this case we can see that Forex Cruise Control is profitable from just 30 pips. The optimum stop loss is 190 pips which returns a profit of 3961 pips, however a lower stop could be more suitable for traders with a lower risk appetite. For example a stop of 150 pips generates nearly the same profit as a stop of 190 pips for lower risk.

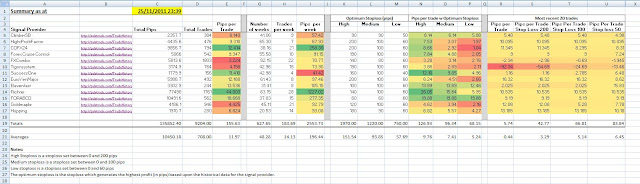

Once we have used this information in excel it is straightforward to carry out additional useful analysis such as pips per trade, pips per week and most recent trading results.

By analyzing the data of signal providers in excel we get a clearer picture of how profitable the signal provider will be in the future by applying our own stop losses. I steer clear of those providers who are not profitable from stops of 100 pips or below as the risk is too high for my own preferences and I don't want to be carrying open trades with high losses.

In conclusion using excel to analyze signal providers trading data provides a clearer understanding of the risk involved with the signal provider and how profitable the provider will be when applying stops. It is interesting that many providers with high rankings do not perform well when applying tight stops to their trading data.

Disclaimer: I am not a forex expert and this opinion is mine only, please conduct your own due diligence before trading with zulutrade or using any of the signal providers mentioned in this article.